History repeats itself

“The reinsurance market is going through a consolidation phase,” wrote Swiss Re in 1998, and here we go again, or so it seems.

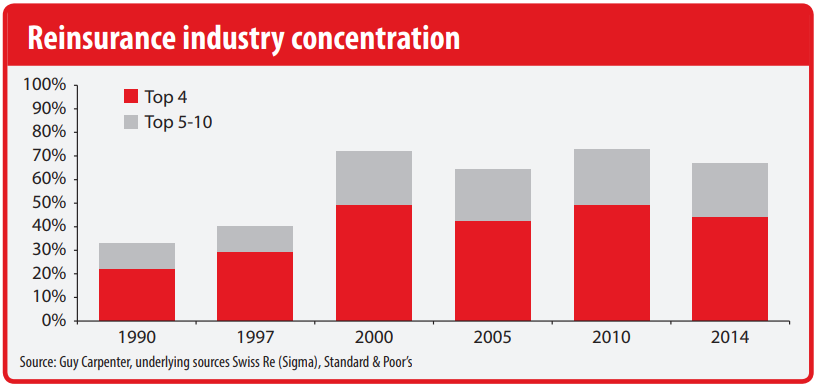

Since 2014, there have been four M&A deals within the reinsurance space that were pure consolidations rather than transactions by an acquirer from outside the sector. To date, we estimate that this consolidation wave has affected some $11bn of net premium income and 5 percent of the global reinsurance market. However, that is short of the $16bn and 13 percent, respectively, impacted by M&A in the mid-1990s.

There is nothing unusual about M&A. It is a cyclical phenomenon and very much in tune with the broader financial market environment.

Market concentration peaked 15 years ago

The market shares of the leading reinsurers have not changed materially since 2000. The obvious conclusion to draw from this is that the industry’s concentration has attained a stable and mature equilibrium that has endured for almost 15 years.

However, this equilibrium still enables new entrants and an influx of alternative capital. It is interesting to observe that among the new entrants in the top 20 global reinsurance groups in 1994 there were just two Asian groups, while by 2014 there were six. For Bermuda it is a similar story, increasing from one to three.

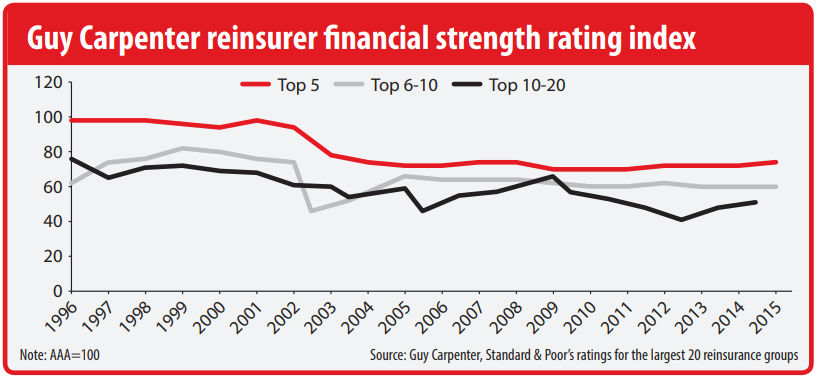

Size does not matter so much as financial security

Following the liability crisis of the 1980s and again after Hurricane Andrew in 1992, several leading reinsurers promoted a “flight to quality” hypothesis, both as a trigger for consolidation and to attract more business.

Although this may have brought some success, it fizzled out in the early 2000s amid reserving shortfalls and falling stock markets and then died with the financial crisis. It also did not prevent several, eventually shortlived, new entrants from joining the market during this period.

More recently, the new concept coming from the leading reinsurers is “tiering”, as the top ranking carriers attempt to impress insurers with their “superior” credentials and justify preferential terms of trade.

The real questions that insurers need answered concern a reinsurer’s financial strength, quality of assets, capital structure and administration, risk appetite and risk management. As we cross the midpoint of the credit cycle these questions assume even more relevance. A bigger balance sheet does not equate to higher financial security or even address these other issues.

The chart below shows the top 20 reinsurers’ financial strength ratings have been in long-term decline since the mid1990s despite a significant increase in scale over the same period. It is also noticeable that the ratings of the top five reinsurance groups have been converging with the other top reinsurer groupings.

Other considerations arising out of M&A

While M&A may assist insurers in reducing the size of their reinsurance panel, including through larger line sizes, it can also materially increase their exposure to the combined group. Potentially, this can create difficulties for insurers with large exposure or concentration limits to a single entity or group. In any case, we would anticipate that concentration risk will grow in importance for insurers under the Solvency II regime.

Other matters for insurers to consider include the newly merged entity’s legal structure, any post-merger restructuring and potential closure of non-core operations and changes to treatment of historic or latent liabilities. All of these can be very complex issues to grapple with and create significant uncertainty for stakeholders.

A final word on purchasing behaviour

M&A has a role and value for customers in most sectors, as long as competition and choice are preserved. The current spate of activity in the reinsurance sector is not a new development and we believe that insurers can benefit from it over the long term as they have done through previous M&A cycles.

However, it is vital that insurers – in collaboration with their advisers – continue to scrutinise their reinsurance relationships prudently and fully understand the implications of a reinsurer’s M&A activity for their business.