This piece was first published on July 17, 2020.

Grocery retail has seen a large surge in sales from the COVID-19 pandemic and associated “lockdowns”, but this surge is likely to slowly recede. As the recession takes hold, grocers need to focus on how they can deliver value to their consumers to ensure they are best-positioned to successfully thrive in the coming months.

As has been widely reported, COVID-19 has detrimentally impacted the economy. In our previous article, Is the Surge in US Grocery Sales Here to Stay?, we discussed how grocery retail has been an exception, and how the industry has significantly benefited from the stay-at-home orders. As we approach the end of the lockdown, we would like to discuss the landscape of grocery retail and assess the changes we expect to see in the coming months.

Since the lockdown began, the traditional “rules of the game” for grocers have been suspended. In particular, decisions about balancing offer and value have become less important due to shifts in consumer behavior:

Price sensitivity has decreased: Shoppers are looking to check off all the items on their shopping lists and have become less concerned with the price of doing so. Many retailers reported lower price elasticities during the lockdown period, especially during the early surge.

Grocery spend has consolidated: Many consumers have reduced their number of trips to supermarkets for safety reasons. Shoppers who previously split their basket between two or more supermarkets have now combined purchases and visit only one store.

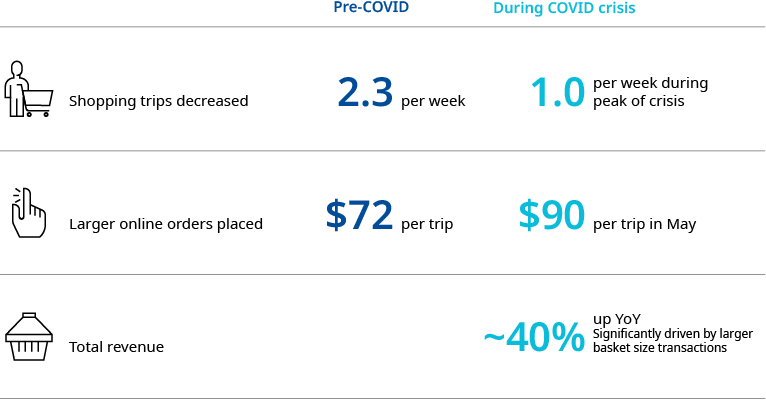

Exhibit 1. Grocery spend trends on average basket size vs. number of trips

Source: Food Navigator-USA; IRI; Brick Meets Click

At the onset of the lockdown, it was very common for stores to experience stock-outs. To improve supply chain predictability, grocers heavily-reduced promotional activity, such as removing buy-one-get-one free offers. The aforementioned shifts in consumer behavior have enabled grocers to make this change without experiencing significant negative ramifications.

However, the status quo seems likely to return. The period of panic-buying has come to an end, as signaled by shelves full of toilet paper! Consumers no longer feel the need to stock up and are becoming more familiar with their new “normal” within grocery shopping. Whether that is putting on a mask and venturing through newly one-way aisles or searching for the best delivery slot online, customers have adjusted to grocery shopping during a pandemic. Furthermore, lockdowns are slowly being lifted, and consumers are more willing to travel further to find value when shopping. The worrisome state of the economy is also accelerating value’s return as a key driver of shopping decisions. Although many industries are slowly reopening, the unemployment rate has risen to the highest level in decades and the US economy is now officially in a recession. Budgets are getting squeezed, making value an increasingly important driver of customers purchasing decisions. Finally, the surge in e-commerce during this period has shifted customers into a highly price transparent channel, which makes it easier for value-conscious shoppers to make their decisions on this basis.

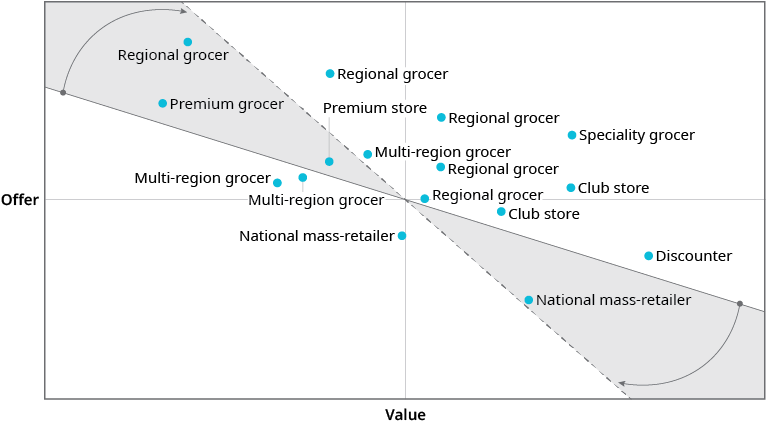

Oliver Wyman’s Customer Perception map shows how consumers trade-off “the offer” against value. The diagonal “fair-trade” line shows the willingness to accept a higher price in exchange for a better offer (defined by a variety of components, such as service, assortment, and quality). If you are above the line, you are over-delivering. History has shown that these players tend to gain market share over time (and the opposite is true for below the line).

Exhibit 2. Oliver Wyman’s Customer Perception Map — Heightened desire for value

Source: Oliver Wyman analysis

Recent trends suggest that groceries are getting more expensive and are unlikely to go down soon. However, consumers are also paying more attention to grocery prices. As we enter summer, and with it, the “New Normal,” we believe that shoppers will be increasingly value-focused, and more willing to trade a weaker offer in favor of better value. Conceptually, this means the “fair trade line” is about to get steeper or rotate clockwise. The shift would put several grocers in potentially precarious positions, at risk of suddenly finding themselves below the line rather than above it. Others will find their competitive position enhanced. Regardless, all grocers will need to anticipate and react to this change in order to successfully navigate the end of the crisis.

Actions You Should Take

Ensure Your Assortment Strategy is Appropriate for Newly Price Conscious Consumers

Invest in your private brand strategy

Consumers bought more private label products during earlier stock-outs. Their propensity to purchase private label products has increased, making this the perfect time to consolidate your gains in private brand penetration. Entry-price products, in particular, play a crucial role in value perception, which we anticipate will be increasingly important. As long as you can maintain scale to support attractive private brand economics, these products can deliver margin to reinvest or offset increases in cost of doing business.

Identify opportunities for SKU consolidation

Through the crisis, customers have been forced to switch brands when their usual purchase has been unavailable and have learned that many products are interchangeable. This provides retailers with an opportunity to reduce SKU count, and shift volume to specific brands with preferential financial terms. An ancillary benefit will likely be a simpler and more cost-effective supply chain.

Increase value-pack size offering

Value-conscious consumers are looking to sacrifice the convenience of smaller pack sizes for cheaper unit prices. Retailers should use purchase data to identify where customers frequently buy multiple units of the largest pack size and introduce a value-pack to meet customers’ needs.

Reevaluate Your Value Strategy

Assess balance of value being provided through low base price versus promotional activity

Retailers quickly need to identify the products for which they wish to be known for delivering everyday value. Once identified, retailers should pre-empt risk of price competition by partnering with their suppliers to offer better value on these products without significantly impacting margins.

Evaluate the targeting of your price-investments

A strong value-based pricing strategy, especially on basic products and key value indicators, is required to respond to changing customers’ needs. Retailers should be deliberate, both when using price-investments to deliver value and when selecting products to make margin on.

Optimize your promotional programs

We expect promotional elasticity to return. Consequently, the economics of promotions are likely to change (again). Retailers need to revise the assumptions in their promotional planning, manage vendor funding, and improve data feedback loops to optimize the returns from future promotional programs.

Fund Net Price-Investments Through Cost-Efficiencies

Cost reduction programs are more effective if they are self-initiated and focus on specific long-term outcomes. Here, the outcome is to deliver additional value to customers such as fund price-investments.

Embed the cost efficiencies identified through the lockdown

Retailers have been forced to respond to customer safety concerns. Any changes that increased efficiency and/or reduced costs should be made permanent. For example, retailers should heavily reduce travel expenses and use the crisis as a benchmark for what internal reporting is truly required.

Expand elements of tighter spend-control

Where possible, retailers should shift to zero-based budgeting, ensuring future initiatives target a low cost. Procurement should streamline payment terms across suppliers and optimize their operating model for better spend-control and risk management.

Evaluate workspace requirements and negotiate leases accordingly

Retailers have learned how location agnostic head office can be. Findings from the lockdown should form the basis of “future workspace” discussions, including whether a HQ is even necessary. When negotiating leases, retailed should leverage awareness that “essential services” will still pay rents if a “second wave” of COVID-19 occurs.

For more detail on effective cost management, please refer to “Beat the Cost Curve.”