This interview originally appeared on Brink on November 27th, 2017.

It’s no secret that we are in the midst of an unprecedented era of global disruption. This disruption is being enabled by the rise of new technologies such as artificial intelligence, blockchain and the Internet of Things—each with the ability to pave new and profound ways for enterprises to innovate, interact and operate.

Each new day brings revelations of this disruption—consider the following:

- DataBridge Market Research estimates that robotic process automation—a $698.5 billion market in 2016—will experience a nearly 29 percent compound annual growth rate over the next seven years.

- In November, the New York Times brought us word of Google’s AutoML, a machine learning project “that learns to build other machine-learning algorithms.”

- The World Economic Forum noted that 7 million jobs could be lost over next 5 years through redundancy, automation or disintermediation, with the greatest losses in white-collar office and administrative roles.

The future isn’t twenty years away. It’s here now. The use of emerging technologies to drive transformation and growth is now a leading agenda item of board and leadership discussions. Many executives across industries are scrambling to understand how to best deploy these technologies to improve their customer’s experience, make better internal decisions, reduce operational risk or improve workforce efficiency.

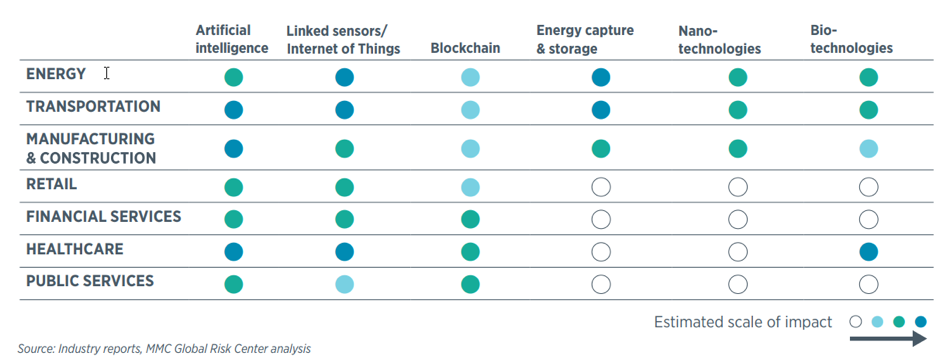

Figure 1: Impact of emerging technologies on major industries (illustrative)

So how does finance and treasury fit into this picture? As the gatekeepers to the financials and the managers of corporate risk, CFOs and treasurers play a critical role in advising their CEOs and board members on the opportunities and risks associated with leveraging these technologies. The idea of transformation isn’t a new topic to the finance and treasury departments. For years, finance and treasury leaders have been evolving their functions to play a more advisory role in strategic planning, forecasting, acquisitions and navigating complex regulatory environments.

However, a recent survey from the Association for Finance Professionals reveals that while finance and treasury professionals recognize the potential of emerging technology, they are not prepared to embrace it. When asked, “Are organizations prepared to deal with the impact of new technologies within the treasury & finance function,” only 11 percent answered either “very prepared” or “fully prepared.” A majority (53 percent) of respondents said their organizations were “somewhat prepared,” while another 36 percent said “minimally or not prepared.”

There are a few reasons behind this challenge. First, most finance and treasury teams desire a concrete, unambiguous return on any investment, let alone betting on the future of their firm based the promises of emerging technologies. This also highlights treasury’s inherent risk aversion in implementing these technologies. Finally, most finance and treasury departments are small and beleaguered by their day-to-day activities. In many cases, they do not have the resources to adequately investigate the nature and implications of these technologies.

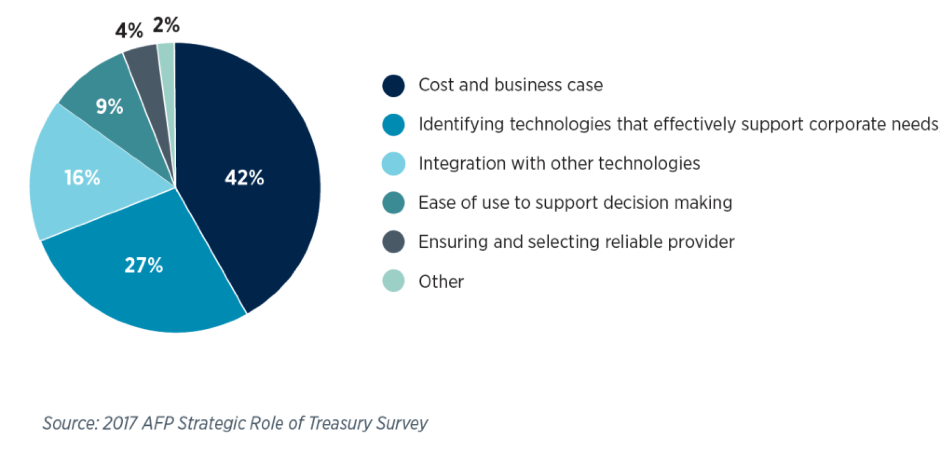

Figure 2: Key challenges for the treasury department in determining adoption of emerging technologies (% distribution of organizations)

Some of these concerns are justified. While many firms are broadly optimistic about the perceived benefits of adopting new technologies, there are three major challenges that they will need to navigate before deploying them:

Lack of clear standards and governance: Many new technologies still lack clear development standards and governance controls. Without a stable, predictable and transparent set of standards to act as guardrails, companies will expose themselves to additional operational risk and loss of public confidence.

Employment challenges and war for talent: Any activity that is manual, repeatable and scalable will get automated. Staff members will require a clear retooling, retraining and reskilling strategy. Specialist skillsets to help organizations deploy new technologies are in demand and scarce, leading to a war for talent.

Rising cyber risk exposure: The emergence of new technologies is happening against the backdrop of a rapidly shifting cyber threat landscape. Cyber adversaries are becoming increasingly technical, innovative and ruthless. Companies that deploy emerging technologies in their environment naturally increase their vulnerability to a cyberattack.

Keeping these challenges in mind, executives across industries are getting serious about assessing and deploying technologies such as robotic process automation, artificial intelligence, and blockchain across their enterprises. It is only a matter of time before these technologies will become table stakes in enabling more competitive offerings, and doing work better, faster and cheaper.

It is incumbent on finance and treasury executives to better understand the opportunities and the implications of emerging technologies. One way to accomplish this is through a program called “Mindshift,” created by the Association for Financial Professionals, Marsh and McLennan Companies’ Global Risk Center and Starfish Leadership.

We are just scratching the surface on the capabilities of these new technologies. Sitting still and waiting it out isn’t an option. Finance and treasury professionals need to be prepared to understand and embrace these new technologies—or get ready to be disrupted.