Banking provides a fertile ground for artificial intelligence. After all, AI lives on data, and banks are information businesses with terabytes of data. One breakthrough in AI is supervised learning, which enables a machine to mimic a human’s decision-making process based on what may be millions of examples. This advance has made switching to an AI-first business model a natural progression for banks, which are leading the charge in digital and mobile-first strategies.

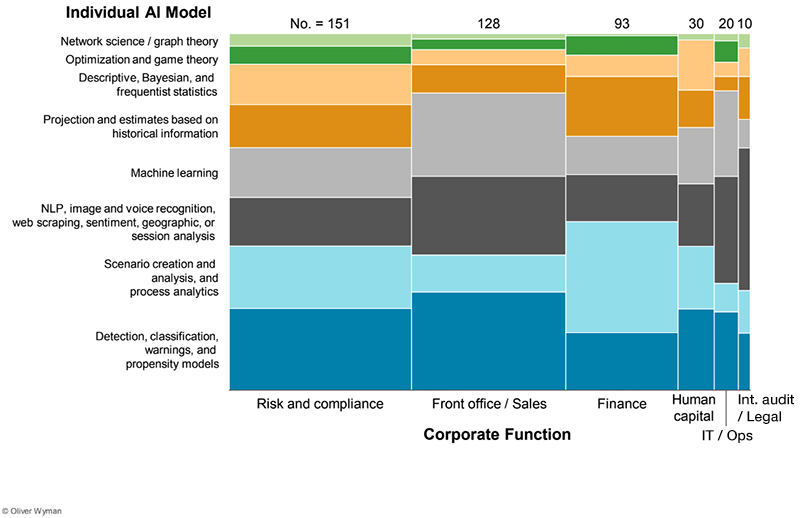

If properly deployed in the next five to seven years, we estimate that AI could increase banks’ revenues by as much as 30% and potentially reduce their costs by 25% or more. To date, however, most banks have been scattershot in their approach to deploying AI, with models ranging from customer-support chatbots to price-elasticity analytics. But rolling out one model at a time, à la carte, without an overriding strategy, is certainly a recipe for failure given the hundreds of possible use cases AI now provides. (See “AI-First Bank Use Cases.”)

Banks need a clear AI strategy to get this transformation right. If they don’t have one, other banks that master AI will offer their customers more tailored services with lower fees. The template we’ve found working with global financial services companies to develop AI-first business models — and avoid being trapped in a revolving door of AI initiatives that are ultimately ineffective — can work for organizations in other industries as well. The most successful AI strategies are driven by four pillars: improving data assets, scaling infrastructure to allow widespread experimentation, enlisting employees so that they scout for new AI use cases, and looking for ways AI can solve customers’ problems beyond providing banking services.

A structural approach is needed to handle the hundreds of possible use cases AI now provides.

Below are the four key components of a successful AI strategy, with examples of how leading companies have shifted to an AI-first paradigm:

1. Improve Data Assets

Most AI models for banking are relatively easy to build, copy, or buy. What makes them valuable is data when it is easy to access, load, and prepare for AI algorithms. Right now, banks have serious problems organizing their data. It is scattered across systems, making it cumbersome to retrieve. Customer interactions within branches are only partially logged, for example, even though these conversations are some of most valuable assets a bank has. Imagine how much richer customer profiles would be if you knew the thought process that preceded a product purchase.

A bank needs to develop a systematic way to build up its data assets, using instant access to internal and external sources, with both historic and real-time data. At the same time, a bank needs to subtly balance proactive collation of different data sets versus a reactive search for data when the business seeks to deploy a specific AI application. The objective should be to capture and stockpile data that is relevant to models you have or want to build.

For instance, American Express is harnessing the power of its data, derived from over 100 million credit cards that account for over $1 trillion in charges every year, by migrating many of its traditional processes from legacy mainframes to big-data databases. Using machine learning algorithms, Amex can now use data on cardholder spending across more than 100 variables to provide customized offers to attract and retain customers. Amex also leverages this information to match merchants with customers who are likely to spend more and be loyal.

2. Deploy AI at Scale

To be effective, an AI-first bank needs to deploy AI models at scale. That means facing the possibility of thousands of models running at any moment, some serving millions of customers or reviewing millions of transactions per day. Many of these models will be recalibrated monthly, some even daily.

Deploying one AI model is not particularly difficult but applying it to a million people is a challenge due to the unpredictable nature of client contexts. And managing multiple models, even hundreds of models, raises the degree of difficulty several more notches.

Part of the problem is that AI is like alchemy: We don’t fully understand why it works and when it might break down. In assessing creditworthiness, for example, a model that has not been well-tested might jump to conclusions about people based on a few pieces of data, such as home address or education level.

Banks need to develop their infrastructure with one clear deployment platform across the organization and a method for managing models. JPMorgan Chase, for example, last year budgeted $10.8 billion for technology investments, with more than $5 billion earmarked for new investments. These investments have enabled several AI initiatives at scale, including routine automation that can process 12,000 credit agreements in seconds — which used to take 360,000 person-hours of manual review; customer-transaction analysis to support follow-up trading; and a chatbot that will free up people for higher-level tasks while providing top-notch customer support 24/7.

3. Ingrain AI in the Organizational Culture

It is important that employees see AI as an opportunity, not as a threat to their job security. AI can be applied widely to both support people and fully automate processes. To identify potential opportunities, employees need to scout for them. By using robots to perform rote, repetitive tasks, organizations will be able to open up pathways for new business models that serve clients better while freeing the employees’ time for higher-level work.

Allstate Business Insurance Expert’s web-based chatbot ABIE, for example, helps agents quote and issue Allstate Business Insurance products without engaging a call center, enabling them to sell more insurance. ABIE answers questions and finds critical documents. It understands the agents’ context — who they are, what product they’re working on, and where they are in the process.

Similarly, HSBC is working with Ayasdi, a Silicon Valley AI startup, to automate money-laundering investigations that have traditionally been conducted by people. HSBC creates a decision tree to show how decisions are made, aiming to bypass the “black box” rap against machine learning, which cannot be allowed in the tightly regulated finance sector. HSBC claims to have unearthed many new patterns directly correlated to fraud — as well as reducing HSBC’s false alerts by 20%.

4. Extend AI Services Beyond Banking

The boundaries between banking, financial advice, and other advisory services are blurring. AI will only accelerate this trend. This presents an opportunity for banks to become trusted financial advisers on a range of issues, from car purchases to health advice. Many other businesses have showed that if you focus on customer problems, the profits will follow.

Ping An, a Chinese AI-first, financial-services provider, has implemented a Good Doctor AI service. It allows for remote diagnosis of a health concern, using a chatbot to understand a patient’s situation, provide initial diagnosis, and direct the patient to the most suitable doctor. The platform manages 300,000 to 400,000 daily consultations, with roughly 1,000 medical professionals providing continuous feedback.

This bold extension beyond financial services into health care, not typically considered an adjacent space, highlights the potential for AI to widen the playing field — and the need for banks, already competing with fintechs in the finance space, to make the AI transformation and stave off further business erosion.

Move Along the AI Continuum

AI is now a natural fit for banks and will increasingly be suitable for other companies as all industries become progressively more digital. As we’re already seeing in financial services, if properly applied, AI can drive down costs and improve customer experience. But to get these benefits, AI must be deployed at scale in a differentiated way.

Companies both inside and outside of financial services need to adopt a clear AI-first strategy. Otherwise, they risk creating a web of interconnected models, with many analogs to the troublesome, patchwork IT architecture of the past.

Once companies have a clear AI strategy and management plan, they can build relatively simple models that provide a short-term impact. The financial benefits of these short-term models can then pay for build-out of the platform needed for more sophisticated models further down the line.

Given the benefits in terms of cost savings and new customer acquisitions, the potential of AI is too large to ignore. So is the threat from startups who are moving along the AI continuum, looking to lure customers away from less agile competitors. The time to think in terms of AI-first business models is now.